Hey there, folks. Let's dive into something pretty serious but also super relevant right now. Goldman Sachs downgrades U.S. economy is making waves across the financial world, and it's not just some random headline. This is a big deal, and if you're wondering why, well, buckle up because we're about to break it all down for you. Imagine your favorite financial powerhouse ringing the alarm bells—yeah, that's kind of what's happening here.

So, here's the deal: Goldman Sachs, one of the most respected names in global finance, has recently decided to tweak their forecast for the U.S. economy. They're not exactly painting a rosy picture, and that's got everyone from Wall Street to Main Street scratching their heads. But don't panic just yet—we're here to explain what this downgrade means and why it matters to you.

Now, you might be asking, "Why should I care about some big bank's opinion on the economy?" Well, here's the thing: when a giant like Goldman Sachs speaks, people listen. Their insights can influence everything from stock markets to your retirement savings. So, let's unpack this together and figure out what's really going on.

Read also:Tamil Movies Download Your Ultimate Guide To Exploring The World Of Tamil Cinema

What Exactly Does "Downgrade" Mean in This Context?

Alright, let's start with the basics. When Goldman Sachs downgrades the U.S. economy, it means they're revising their expectations for how well the economy will perform in the near future. Think of it like a weather forecast—if the meteorologists predict rain, you probably grab an umbrella. Similarly, when economists downgrade their outlook, it's a signal that things might not be as sunny as they hoped.

In this case, Goldman Sachs is saying that the U.S. economy might grow more slowly than they initially thought. This could mean fewer jobs, lower wages, or even a potential recession. But before you start stockpiling canned goods, let's explore what led them to this conclusion.

Why Did Goldman Sachs Decide to Downgrade?

There are a few key factors behind this decision. First off, inflation has been running wild, and it's not showing any signs of slowing down. Prices for everything from groceries to gas are climbing, which puts a strain on consumers and businesses alike. Second, there's the ongoing battle with rising interest rates. The Federal Reserve has been hiking rates to try and tame inflation, but that comes with its own set of challenges.

Lastly, global uncertainties—think geopolitical tensions, supply chain disruptions, and other fun stuff—are adding to the mix. All these factors combined have made Goldman Sachs rethink their original forecast. It's like when you plan a picnic, but the weather forecast changes at the last minute. You adjust your plans, right? That's what they're doing here.

How Does This Impact You?

So, how does this downgrade affect the average Joe or Jane? Well, it depends on where you stand financially. If you're an investor, you might see some volatility in the stock market. If you're a job seeker, there could be fewer opportunities out there. And if you're just trying to make ends meet, you might feel the pinch of higher prices even more.

But here's the good news: a downgrade doesn't mean the sky is falling. It's simply a warning sign that we might need to tighten our belts a bit. Think of it as a heads-up to start saving more, spending less, and maybe even revisiting your financial goals.

Read also:New Tamil Movies Download Your Ultimate Guide To Streaming And Downloading

Key Takeaways for Individuals

- Monitor your expenses and cut back where you can.

- Consider diversifying your investments to reduce risk.

- Stay informed about economic trends and adjust your plans accordingly.

The Broader Economic Implications

Now, let's zoom out and look at the bigger picture. When a major player like Goldman Sachs downgrades the U.S. economy, it sends ripples through the global financial system. Other banks, institutions, and governments take notice and may adjust their strategies as well. This could lead to changes in trade policies, investment flows, and even international relations.

For example, if the U.S. economy slows down, it could impact countries that rely heavily on American exports. It might also affect currency values and interest rates around the world. So, while this downgrade might seem like a domestic issue, its effects are felt far and wide.

Global Reactions to the Downgrade

Already, we're seeing reactions from various corners of the globe. Some countries are expressing concern about the potential impact on their own economies. Others are taking a wait-and-see approach, hoping the U.S. can stabilize its situation. Meanwhile, financial experts are busy analyzing the data and offering their own predictions.

It's like a giant game of chess, where every move has consequences. And in this case, Goldman Sachs just made a pretty significant move that everyone is watching closely.

What Does the Data Say?

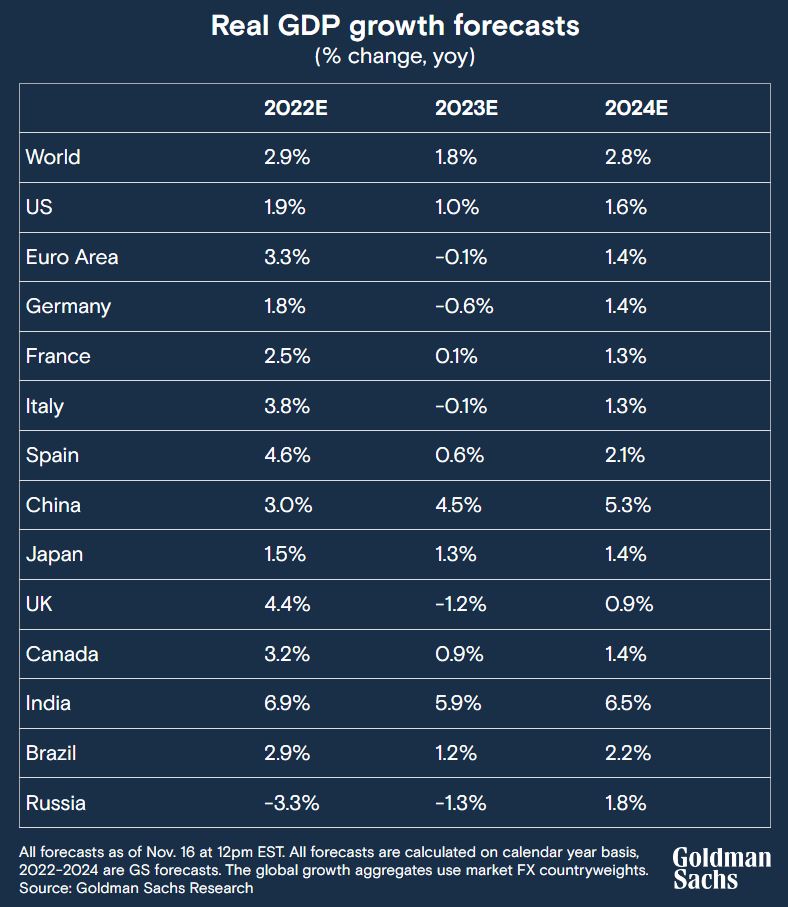

Let's talk numbers for a moment. According to Goldman Sachs, they've revised their GDP growth forecast for the U.S. from 2.8% to 1.9% for the upcoming year. That's a pretty substantial drop, and it reflects their concerns about the current economic climate. They also expect unemployment rates to rise slightly and consumer spending to slow down.

These figures might sound abstract, but they have real-world implications. For instance, a slower GDP growth rate could mean fewer business expansions, which in turn could lead to fewer job openings. And when people spend less, it affects everything from retail sales to restaurant bookings.

Breaking Down the Numbers

- GDP Growth Forecast: Revised from 2.8% to 1.9%

- Unemployment Rate: Expected to rise by 0.5%

- Consumer Spending: Projected to decline by 1.2%

How Have Other Experts Responded?

Of course, Goldman Sachs isn't the only voice in the room. Other financial analysts and economists have weighed in on this downgrade, offering their own perspectives. Some agree with the assessment, pointing to similar concerns about inflation and interest rates. Others, however, believe that the U.S. economy is more resilient than it seems.

For example, a recent report from the International Monetary Fund (IMF) suggested that while challenges exist, the U.S. economy still has strong fundamentals. Meanwhile, the Federal Reserve remains committed to its strategy of gradual rate hikes, hoping to strike a balance between controlling inflation and avoiding a recession.

Different Perspectives on the Downgrade

It's important to remember that not everyone sees things the same way. While Goldman Sachs has chosen to downgrade their outlook, other experts might have different interpretations of the data. This diversity of opinion is what makes economics such a fascinating—and sometimes frustrating—field.

So, as you're digesting all this information, keep in mind that there's no one-size-fits-all answer. The truth probably lies somewhere in the middle, and it's up to each of us to make sense of it in our own way.

What Can We Expect Moving Forward?

Looking ahead, the next few months will be crucial for determining whether Goldman Sachs' downgrade was spot-on or overly pessimistic. Key indicators to watch include inflation rates, employment numbers, and consumer confidence. If these metrics improve, it could signal that the economy is stabilizing. On the other hand, if they continue to decline, it might confirm the bank's concerns.

One thing is certain: the financial world will be keeping a close eye on developments. Investors, policymakers, and everyday people alike will be analyzing the data and adjusting their strategies as needed.

Predictions for the Future

- Inflation may start to ease by the end of the year.

- Unemployment rates could stabilize or even decrease slightly.

- Consumer spending might pick up as people adapt to the new normal.

Final Thoughts and Takeaways

Alright, let's wrap this up. Goldman Sachs downgrading the U.S. economy is definitely a big deal, but it's not the end of the world. It's a signal that we need to be mindful of the challenges ahead and take proactive steps to protect ourselves financially.

Here's what you should do moving forward:

- Stay informed about economic trends and updates.

- Review your budget and make adjustments as needed.

- Consider consulting with a financial advisor for personalized advice.

And remember, while the economy might have its ups and downs, resilience and adaptability are key. So, whether you're a seasoned investor or just someone trying to make smart choices, keep your eyes on the prize and don't lose sight of your long-term goals.

Call to Action

Now it's your turn. Got any thoughts or questions about Goldman Sachs downgrading the U.S. economy? Drop a comment below or share this article with your friends and family. Knowledge is power, and the more we understand what's going on, the better equipped we are to handle whatever comes our way.

Thanks for reading, and until next time, stay sharp out there!

Table of Contents

- What Exactly Does "Downgrade" Mean in This Context?

- Why Did Goldman Sachs Decide to Downgrade?

- How Does This Impact You?

- The Broader Economic Implications

- What Does the Data Say?

- How Have Other Experts Responded?

- What Can We Expect Moving Forward?

- Final Thoughts and Takeaways

- Call to Action