Apple earnings have always been the talk of the town, especially when you're dealing with a company that's worth over a trillion dollars. Imagine this: a single earnings report can send ripples across the entire tech industry, and investors are hanging onto every word. It's not just about numbers; it's about how Apple continues to innovate and dominate in a world where competition is fierce. So, buckle up because we're diving deep into the nitty-gritty of Apple's financial performance.

Now, let's set the stage. Apple isn't just any company; it's a household name that's synonymous with cutting-edge technology, sleek design, and unmatched brand loyalty. But what happens when the curtain is pulled back, and we see the numbers behind the magic? That's where the earnings reports come in. They're like a secret code that tells us whether Apple is still on top of its game or if there's trouble brewing on the horizon.

Here's the thing: understanding Apple earnings isn't just for financial analysts or stock traders. It's for anyone who's curious about how one of the world's most valuable companies operates. Whether you're an investor, a tech enthusiast, or just someone who loves their iPhone, this article is going to give you all the insights you need. Let's get started, shall we?

Read also:Hd Hub 4 The Ultimate Streaming Experience Yoursquove Been Waiting For

What Are Apple Earnings Reports?

Alright, let's break it down. Apple earnings reports are basically financial snapshots that the company releases to the public. These reports give us a peek into how much money Apple has made, how much it's spent, and what its plans are for the future. It's like getting a report card for a company that's as big as Apple.

Here's the deal: Apple releases these reports quarterly and annually. The quarterly reports are like progress updates, while the annual reports give us the big picture. And let me tell you, investors and analysts go bananas every time a new report drops. Why? Because these numbers can make or break stock prices. If Apple's earnings are higher than expected, the stock price might skyrocket. But if they're lower than expected, well, let's just say it's not a pretty sight.

Why Should You Care About Apple Earnings?

Now, you might be thinking, "Why should I care about Apple's financials if I'm not an investor?" Great question! The truth is, Apple's earnings have a ripple effect that goes way beyond the stock market. When Apple does well, it means more jobs, more innovation, and more cool gadgets for consumers like you and me. Plus, if you're a fan of Apple products, understanding their earnings can give you a better idea of what to expect in terms of new releases and pricing.

For example, if Apple reports a strong quarter, it might mean they have more resources to invest in R&D, which could lead to even better products down the line. On the flip side, if their earnings are lackluster, it could mean they're facing challenges that might affect future releases. So, whether you're a stockholder or just a tech enthusiast, Apple's earnings are worth paying attention to.

Apple Earnings: A Historical Perspective

Let's take a trip down memory lane. Apple hasn't always been the tech giant it is today. Back in the day, they were just another computer company trying to make a name for themselves. But then, something magical happened. They started releasing products that people couldn't live without, like the iPod, the iPhone, and the iPad. And with each new product, their earnings skyrocketed.

Here are some key milestones in Apple's earnings history:

Read also:7starhd Movies Your Ultimate Destination For Blockbuster Entertainment

- 2007: The launch of the iPhone marked a turning point for Apple. It wasn't just a phone; it was a game-changer. And the earnings reports reflected that, with revenue numbers that were through the roof.

- 2010: The iPad hit the market, and Apple's earnings reports showed just how popular this new device was becoming. It was like nothing we'd ever seen before.

- 2018: Apple became the first publicly traded U.S. company to reach a market cap of $1 trillion. Their earnings reports were the driving force behind this historic achievement.

As you can see, Apple's earnings have played a crucial role in shaping the company's trajectory. They've been the fuel that's powered Apple's growth and innovation over the years.

Breaking Down the Numbers

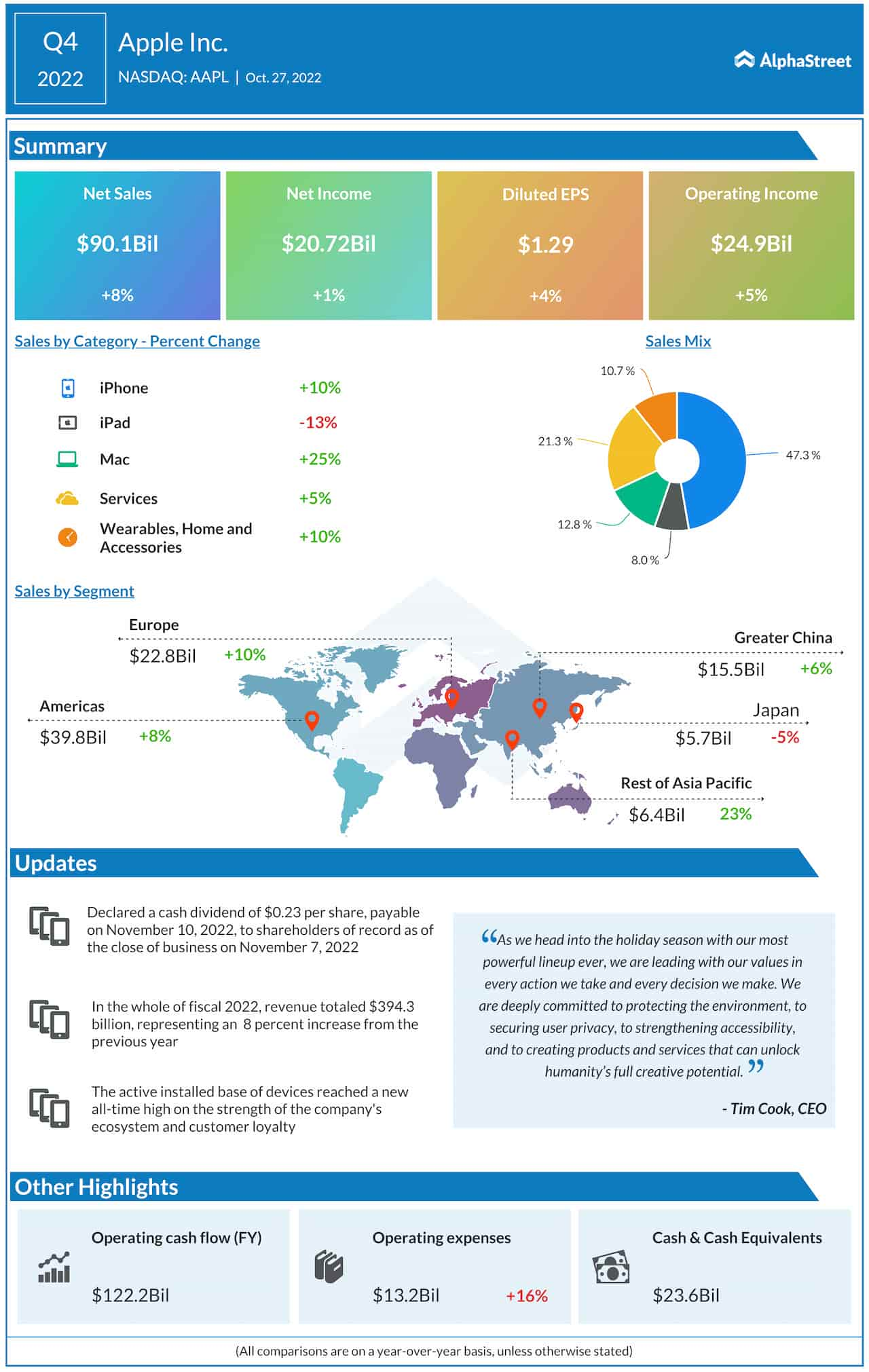

Now, let's get into the nitty-gritty. When you look at an Apple earnings report, there are a few key metrics you need to pay attention to:

- Revenue: This is the total amount of money Apple brings in from selling products and services. It's like the company's paycheck.

- Net Income: This is the profit Apple makes after all the expenses are taken care of. Think of it as the company's take-home pay.

- Earnings Per Share (EPS): This tells us how much profit Apple makes for each share of stock. It's like slicing the pie and seeing how big your piece is.

These numbers are what investors and analysts use to gauge how well Apple is doing. And let me tell you, when these numbers are good, everyone's happy. But when they're not, well, it's like a storm hitting Wall Street.

Apple's Revenue Streams

Now, here's the thing: Apple doesn't just make money from selling iPhones. Oh no, they've got a whole ecosystem of products and services that contribute to their bottom line. Let's break it down:

iPhone Sales

The iPhone is still Apple's bread and butter. It's the product that everyone knows and loves, and it accounts for a huge chunk of their revenue. But here's the kicker: Apple doesn't just rely on selling new phones. They also make money from upgrades, accessories, and even repairs. It's like a never-ending cycle of profitability.

Services

Apple's services division is growing faster than ever. This includes things like the App Store, Apple Music, iCloud, and Apple Pay. It's like a second revenue stream that keeps the money flowing even when hardware sales slow down. And let me tell you, investors love this diversification.

Wearables and Accessories

Don't forget about the wearables! Apple Watch, AirPods, and other accessories are becoming increasingly popular. They're not just cool gadgets; they're also big moneymakers for Apple. And with more people adopting these products, the revenue from this segment is only going to grow.

Factors Affecting Apple Earnings

Now, let's talk about what can make or break Apple's earnings. There are a few key factors that investors and analysts keep an eye on:

Global Economy

The state of the global economy can have a big impact on Apple's earnings. If the economy is doing well, people are more likely to splurge on new gadgets. But if there's a downturn, consumers might tighten their wallets, and that can hurt Apple's bottom line.

Supply Chain Issues

Apple relies on a complex global supply chain to manufacture its products. Any disruptions, whether it's due to natural disasters, geopolitical tensions, or pandemics, can affect production and, in turn, earnings. It's like a giant puzzle, and if one piece is missing, the whole picture can be thrown off.

Competition

Let's not forget about the competition. Apple faces stiff competition from companies like Samsung, Google, and Huawei. If these companies release compelling products or offer better deals, it can affect Apple's market share and, ultimately, its earnings.

The Future of Apple Earnings

So, where does Apple go from here? The future looks bright, but there are challenges ahead. Here are a few things to watch out for:

- Innovation: Apple needs to keep innovating to stay ahead of the competition. This means investing in R&D and coming up with new products that people can't live without.

- Sustainability: With growing concerns about the environment, Apple is under pressure to make its products more sustainable. This could affect costs and, ultimately, earnings.

- Regulation: As a tech giant, Apple is under scrutiny from regulators around the world. Any new regulations could impact how they operate and, in turn, their earnings.

But here's the thing: Apple has a track record of overcoming challenges and coming out on top. They've got the resources, the talent, and the brand loyalty to navigate whatever comes their way.

Investor Sentiment

Investor sentiment plays a big role in how Apple's earnings are perceived. If investors are confident in Apple's ability to grow and innovate, they're more likely to buy and hold onto their stock. But if there's uncertainty or doubt, it can lead to volatility in the stock price. It's like a game of confidence, and Apple needs to keep the faith alive.

Conclusion

So, there you have it. Apple earnings are more than just numbers; they're a window into the inner workings of one of the world's most valuable companies. Whether you're an investor, a tech enthusiast, or just someone who loves their Apple products, understanding these reports can give you valuable insights into the company's future.

Here's the bottom line: Apple has built an empire on innovation, quality, and brand loyalty. Their earnings reports are a testament to their success, but they also highlight the challenges they face in an ever-changing market. As we look to the future, one thing is certain: Apple will continue to be a major player in the tech industry, and their earnings will be a key indicator of their success.

So, what do you think? Are you ready to dive deeper into the world of Apple earnings? Leave a comment below and let us know your thoughts. And don't forget to share this article with your friends and family. Together, let's keep the conversation going!

Table of Contents

- What Are Apple Earnings Reports?

- Why Should You Care About Apple Earnings?

- Apple Earnings: A Historical Perspective

- Breaking Down the Numbers

- Apple's Revenue Streams

- Factors Affecting Apple Earnings

- The Future of Apple Earnings

- Investor Sentiment

- Conclusion