So, here's the deal—tax brackets. Yeah, I know, it sounds like something only accountants and finance nerds care about, but trust me, it affects everyone who earns a buck. Whether you're a freelancer hustling for gigs or a corporate warrior climbing the ladder, tax brackets play a big role in how much of your hard-earned cash you actually get to keep. Let's dive into the nitty-gritty and make sense of this whole tax bracket business, shall we?

Now, you might be wondering, why should I care about tax brackets? Well, here's the thing: understanding them can help you manage your finances better, plan for the future, and even save some cash. It's not just about crunching numbers; it's about making informed decisions that impact your wallet. So, whether you're filing taxes for the first time or trying to optimize your deductions, this guide has got your back.

Before we jump in, let me tell you something cool about this article. It's packed with practical tips, real-world examples, and insights from experts in the field. You'll learn how tax brackets work, how they affect your income, and most importantly, how to navigate them without losing your mind. So, grab a cup of coffee, sit back, and let's unravel the mystery of tax brackets together.

Read also:Hdhub4u Nit Your Ultimate Guide To Movie Streaming

What Are Tax Brackets Anyway?

Let's break it down in simple terms. Tax brackets are essentially ranges of income that are taxed at different rates. Think of them like buckets—each bucket holds a certain amount of money, and the more money you earn, the more buckets you fill up. The government uses these brackets to determine how much tax you owe based on your income level. Pretty straightforward, right?

Now, here's where it gets interesting. The United States uses a progressive tax system, which means that the more you earn, the higher the tax rate you pay on the additional income. But don't freak out—it's not like they take a flat percentage of everything you earn. Instead, only the income that falls into higher brackets gets taxed at those higher rates. Makes sense?

How Do Tax Brackets Work?

Alright, let's get into the details. Here's a quick example to illustrate how tax brackets work:

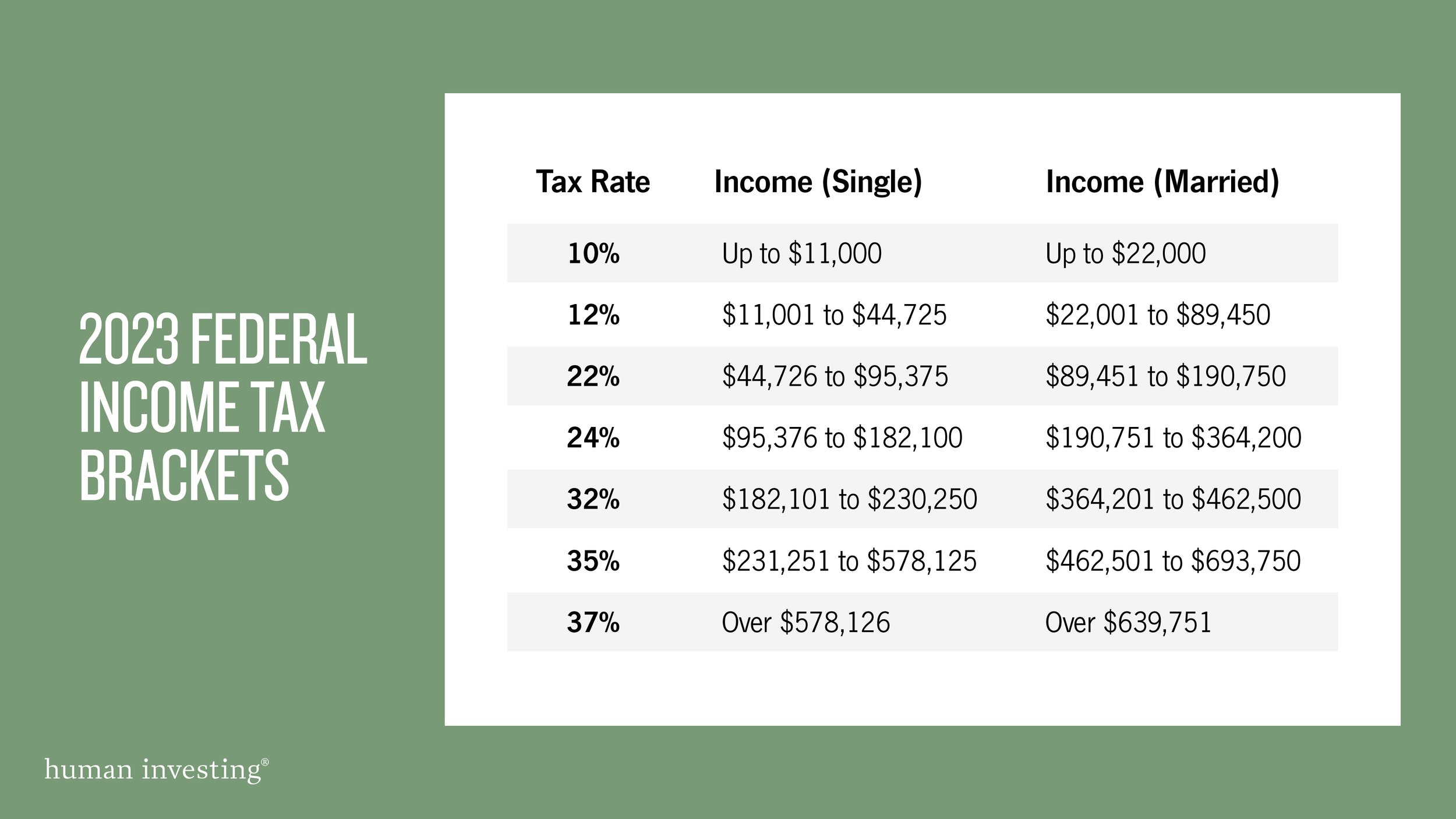

Let's say you're single and you earn $50,000 a year. According to the 2023 tax brackets:

- The first $11,000 of your income is taxed at 10%.

- The next $31,500 (from $11,001 to $42,500) is taxed at 12%.

- The remaining $7,500 (from $42,501 to $50,000) is taxed at 22%.

So, even though you're in the 22% tax bracket, not all of your income is taxed at that rate. Cool, right?

Why Are Tax Brackets Important?

Tax brackets matter because they directly impact how much money you take home. Understanding them can help you plan your finances more effectively and even reduce your tax liability. For instance, if you're close to moving into a higher bracket, you might consider strategies like contributing more to retirement accounts or taking advantage of tax credits.

Read also:Bollyflix Digital Your Ultimate Destination For Bollywood Entertainment

Plus, knowing your tax bracket can help you make smarter financial decisions. For example, if you're thinking about starting a side hustle or investing in a business, understanding how it will affect your taxes can help you avoid unpleasant surprises come tax season.

Common Misconceptions About Tax Brackets

There are a few myths floating around about tax brackets that can lead to confusion. Let's clear them up:

- Myth 1: If you move into a higher tax bracket, all your income will be taxed at the higher rate. Nope! Only the income that falls into that bracket gets taxed at the higher rate.

- Myth 2: Tax brackets are the same for everyone. Wrong! Your filing status (single, married filing jointly, etc.) affects which brackets apply to you.

- Myth 3: Tax brackets never change. Actually, they do! Congress adjusts the brackets periodically to account for inflation and other economic factors.

How to Determine Your Tax Bracket

Finding out which tax bracket you're in is easier than you might think. All you need is your taxable income and your filing status. Here's a step-by-step guide:

Step 1: Calculate your taxable income by subtracting deductions and exemptions from your gross income.

Step 2: Use the IRS tax brackets table to find your bracket based on your filing status and taxable income.

Step 3: Double-check your math to make sure everything adds up. You don't want to end up paying more taxes than you have to!

Tax Bracket Examples

Let's look at a few examples to see how this works in practice:

- Example 1: Single filer with $30,000 taxable income

- Example 2: Married couple filing jointly with $100,000 taxable income

- Example 3: Head of household with $75,000 taxable income

Each example highlights how different income levels and filing statuses affect which tax bracket you fall into.

Strategies to Lower Your Tax Bracket

Now that you know how tax brackets work, let's talk about ways to lower your tax liability. Here are a few strategies:

- Contribute to retirement accounts: Contributions to traditional IRAs and 401(k)s can reduce your taxable income.

- Take advantage of tax credits: Credits like the Earned Income Tax Credit or Child Tax Credit can lower your tax bill.

- Maximize deductions: Itemizing deductions can help you save money, especially if you have high medical expenses, mortgage interest, or charitable contributions.

Remember, the key is to plan ahead and take advantage of every opportunity to reduce your taxable income.

Understanding Marginal vs. Effective Tax Rates

Here's a quick tip: don't confuse your marginal tax rate with your effective tax rate. Your marginal rate is the highest rate you pay on your last dollar of income, while your effective rate is the average rate you pay on all your income. Knowing the difference can help you make better financial decisions.

How Tax Brackets Affect Different Income Levels

Let's explore how tax brackets impact various income levels. Whether you're earning $30,000 or $300,000, understanding your bracket can help you optimize your tax strategy.

For lower-income earners, staying within a lower bracket can mean more take-home pay. For higher-income earners, strategic planning can help minimize the impact of higher tax rates.

Tax Bracket Changes Over Time

It's worth noting that tax brackets can change from year to year. The IRS adjusts them for inflation, and sometimes Congress enacts new laws that alter the brackets. Staying informed about these changes can help you plan ahead and avoid surprises.

Expert Tips for Navigating Tax Brackets

Here are some expert tips to help you navigate the world of tax brackets:

- Consult a tax professional: If you're unsure about your tax bracket or how to reduce your liability, a CPA or tax advisor can provide valuable guidance.

- Use tax software: Programs like TurboTax or H&R Block can help you calculate your tax bracket and explore potential savings.

- Stay informed: Follow financial news and updates from the IRS to stay on top of any changes that might affect your taxes.

Final Thoughts on Tax Brackets

So there you have it—a comprehensive guide to understanding tax brackets. By now, you should have a solid grasp of how they work, why they matter, and how to use them to your advantage. Remember, knowledge is power, and when it comes to taxes, being informed can save you a lot of money.

Conclusion

In conclusion, tax brackets might seem complicated at first, but with a little effort, you can master them and take control of your finances. Whether you're a seasoned pro or a newbie to the world of taxes, understanding how brackets work can help you make smarter financial decisions and keep more of your hard-earned cash.

So, what's next? Take action! Use the strategies we've discussed, consult with a tax professional if needed, and stay informed about changes to the tax code. And don't forget to share this article with your friends and family—spreading the knowledge can help everyone save money and stress come tax season.

Table of Contents

- What Are Tax Brackets Anyway?

- How Do Tax Brackets Work?

- Why Are Tax Brackets Important?

- Common Misconceptions About Tax Brackets

- How to Determine Your Tax Bracket

- Strategies to Lower Your Tax Bracket

- Understanding Marginal vs. Effective Tax Rates

- How Tax Brackets Affect Different Income Levels

- Tax Bracket Changes Over Time

- Expert Tips for Navigating Tax Brackets